Doha, 21 May 2023

Introduction

Africa is projected to experience significant population growth, rising from around 1.4 billion to close to 2.5 billion by 2050, according to the 7th edition of the GECF Global Gas Outlook 2050. This, along with rural-urban migration, primarily by the youth population in search of better career opportunities in cities, is expected to result in almost 1.5 billion people living in cities by that date.

The continent's macroeconomic drivers of energy demand, such as population growth, urban isation, and industrialisation, are more favourable than any other continent.

The African region is on the brink of a massive take-off for industrialisation, with a growing young population, abundant natural resources, and emerging internal markets.

Africa’s real GDP is expected to nearly triple from US$ 2.7 trillion in 2021 to US$7.1 trillion by 2050. This potential for growth relies heavily on energy to provide the necessary amenities in line with the UN Sustainable Development Goals.

Despite Africa's strategic abundance of diverse energy resources and the critical role of

energy in its urbanisation and industrialisation process, significant energy access

problems persist for many Africans. These include limited energy infrastructure that

interconnects African countries from resource base regions to demand sectors, resulting

in vulnerabilities to external shocks. These shocks arise from distant geopolitical

tensions, leading to excessive inflation and cost-of-living crises.

Moreover, excessive greenhouse gas emissions from developed nations contribute to floods and climate-related vulnerabilities, which come at a high cost for Africans, given their low-level

economies and under-industrialisation. The UN SDGs serve as a pathway for African

growth and development in the face of these challenges.

While biomass and renewable energy have large potential in meeting the African energy

demand, urgent need to address indoor pollution from biomass, while lack of much-

needed funding to ensure technology readiness, economic viability, lack of resilience

and intermittency have rendered renewable energy options insufficient to meet African

economic growth potentials, leaving an opportunity to deploy many energy sources, with the abundant and cheap natural gas reserves as the fore-front energy candidate.

2$-$UN SDGs and Africa’s future energy demand

The adoption of the UN SDG 7 goals, with affordable energy as the central pillar,

represents one of the most sustainable pathways for developing the African economy.

The World Health Organization (WHO) has affirmed that "Energy is also critical for

achieving almost all other global goals."

Affordable, reliable, and abundant energy is

crucial for Africa to urgently eradicate poverty (SDG 1), given that more than 455 million

people lived below the poverty line just before the Covid-19 pandemic, with a further 30 m

The role of natural gas in powering Africa’s future million added to this figure after the pandemic. For simplicity, Figure 1 provides a link between some of the UN SDGs to avoid a complicated diagram involving all SDGs.

Pronounced energy poverty is becoming a global challenge due to the spike in energy

and commodity prices, underscoring the need for a more reliable and affordable energy

option. Clean, reliable, and affordable energy has a significant impact on advanced

health (SDG 3), as the WHO considers health to be "inextricably linked" with energy.

This link also extends to the provision of quality education for all (SDG 4), where modern affordable energy is essential for rigorous and comprehensive learning tools and solutions, ranging from sophisticated laboratories to basic classroom lighting.

Moreover, affordable energy access creates an enabling environment for industry, innovation, and infrastructure (SDG 9), providing options for cheap technologies to ensure clean water (SDG 6), improve job security and economic growth (SDG 8), and combat climate change (SDG 13).

These linkages underscore the unprecedented

scientific and historical significance of affordable energy in launching economic growth, which Africans need now more than ever.

The role of natural gas in powering Africa’s future

million added to this figure after the pandemic. For simplicity, Figure 1 provides a link

between some of the UN SDGs to avoid a complicated diagram involving all SDGs.

Pronounced energy poverty is becoming a global challenge due to the spike in energy

and commodity prices, underscoring the need for a more reliable and affordable energy

option. Clean, reliable, and affordable energy has a significant impact on advanced

health (SDG 3), as the WHO considers health to be "inextricably linked" with energy.

This link also extends to the provision of quality education for all (SDG 4), where

modern affordable energy is essential for rigorous and comprehensive learning tools

and solutions, ranging from sophisticated laboratories to basic classroom lighting.

Moreover, affordable energy access creates an enabling environment for industry,

innovation, and infrastructure (SDG 9), providing options for cheap technologies to

ensure clean water (SDG 6), improve job security and economic growth (SDG 8), and

combat climate change (SDG 13). These linkages underscore the unprecedented

scientific and historical significance of affordable energy in launching economic growth, which Africans need now more than ever.

The African continent faces three significant challenges: lingering acute energy access

problems, vast infrastructural deficits, and exposure to vulnerabilities due to rising

geopolitical tensions and climate change. These challenges continue to put Africans at severe risk compared to other continents.

Unfortunately, the issue of African energy

access has rarely been reported or prioritised, despite African energy consumption per capita heing the lowest globally upto five times less than the global average.

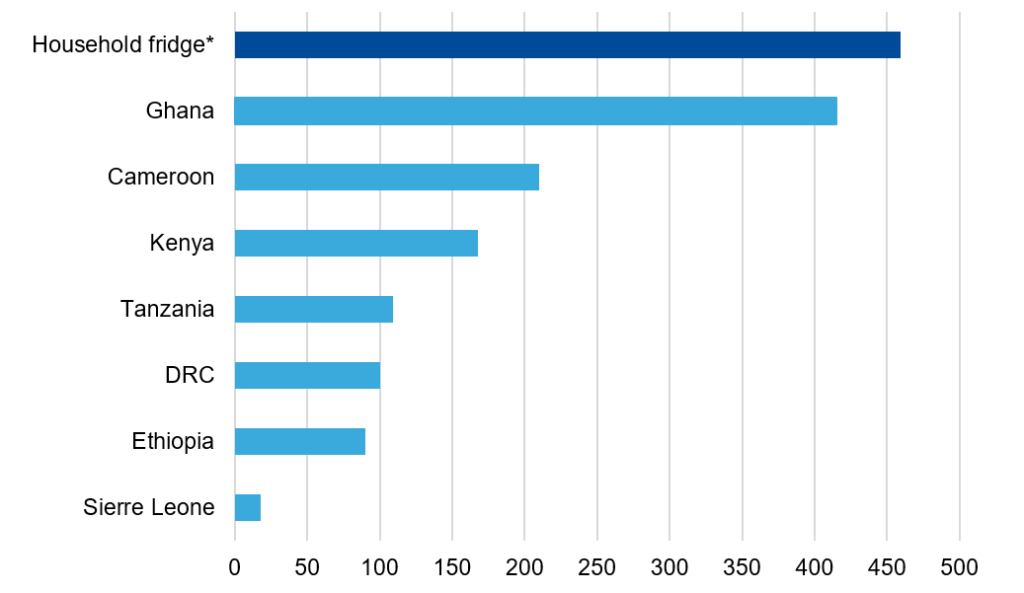

Many African countries suffer from the most severe energy inequality worldwide, with electricity consumption per capita lower than that of an average household fridge.

It is important to note that economic growth is essential in empowering Africans with higher incomes, which in turn enables them to afford energy.

The African continent's vulnerability to geopolitical tensions due to the lack of functional infrastructure emphasises the urgent need to improve energy affordability. Recent

turbulence in the energy market has worsened the situation, pushing African countries

into debt distress, driving up food prices, and exacerbating energy poverty.

This presents a critical opportunity for Africa to harness its economic growth potential and

build a resilient system that can serve as a buffer against rising geopolitical

uncertainties that disrupt supply chains. The only way forward is through the adoption of

affordable, reliable, and abundant energy resources.

The role of natural gas in powering Africa’s future.

The evolution of the energy mix in Africa over the last two decades African region had very marked variations of energy trends, being uniquely divided between sub-Saharan Africa, where energy poverty persists, hampering economic growth, and North Africa and South Africa, having higher economic development

promoted by the stronger electrification and energy requirements.

The region’s energy demand relies heavily on traditional biomass (e.g., wood, dung and

other solid wastes), primarily for cooking. It is by far the most widely used energy source

across Africa, with the exception of South Africa, where the country’s energy mix is

dominated by coal, and North Africa, with natural gas and oil accounting for almost 90%

of sub-region energy demand.

Nevertheless, taking into account expanding African population, some progress has been made in reducing reliance on the inefficient use of traditional sources, as reflected in changing energy mix over the last two decades.

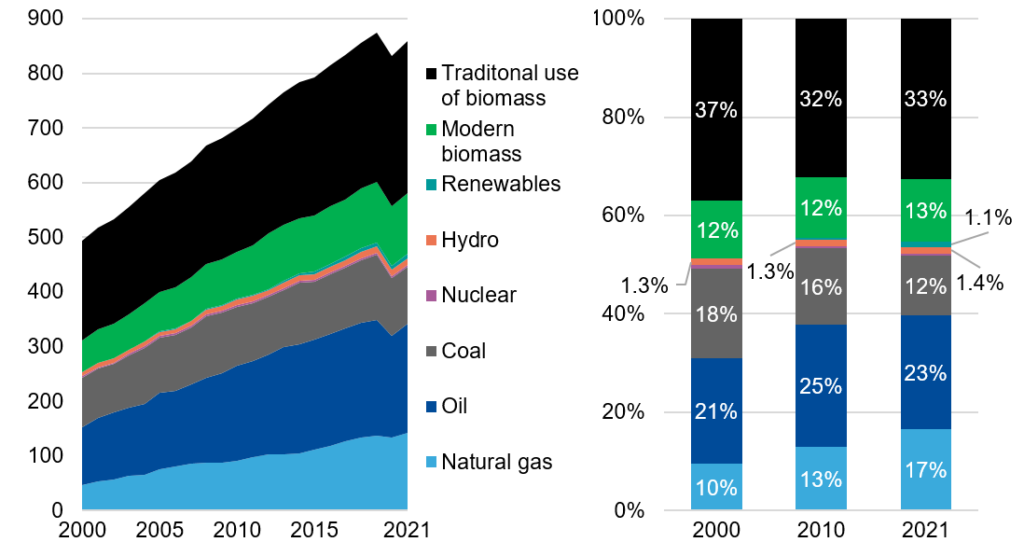

With the total energy demand rising significantly from 495 Mtoe in 2000 to 860 Mtoe in 2021, the share of traditional biomass in the African energy mix dropped from 37% to

33%. Despite its rise in absolute terms, there was observed a shift to modern biomass

along with accelerated penetration of natural gas and oil, driven by strong electrification,

industrial development, increasing vehicle fleet and the uptake of piped gas and LPG

within households. Natural gas specifically contributed 26% to Africa’s energy demand

growth between 2000 and 2021.

As a result, in 2021, natural gas and oil represented around 40% of African energy mix,

up from 31% in 2000. Natural gas overtook coal (which is extensively used in South Africa) as the third largest fuel in 2015 and reached 17% share in 2021, with Algeria, Egypt and Nigeria accounting for the overwhelming majority or around 80% of the continent’s natural gas demand.

The significance of natural gas in Africa In light of the need for a secure, affordable, and sustainable energy source to fuel economic growth and alleviate poverty in Africa, all the available energy options willb continue to be relevant, although at changing energy mix over time. Among the diverse energy options for Africa, the abundance of natural gas and the proven efficiency of combined cycle gas turbines (CCGTs) in power generation make it a suitable complement to renewables in Africa's just transition plan.

However, realising the potential of natural gas requires significant upstream investment

and long-term contracts, which some international investors were hesitant to undertake until recently, that IEA’s position emphasised the importance of expanding natural gas use for Africa’s industrialisation (3). African countries can leverage their natural gas

resources to create a viable long-term investment pathway, particularly by capitalising

on short to medium-term funding opportunities. It is important to note that the rising demand for natural gas in Africa will require increased production to meet domestic needs, with exportation to distant destinations as a potential option. In spite of the

The role of natural gas in powering Africa’s future

underinvestment in the sector, African natural gas reserves are gaining significant

attention for investment, with Africa targeted to supply European Union’s gas demand of

up to 30 bcm by 2030 due to reduced dependency on Russian supply. The recent surge

in demand for African gas supply for the short to medium term due to geopolitical

tensions is unclear. However, Africa must focus on the certainty that gas will be needed

for the future, regardless of potential future events.

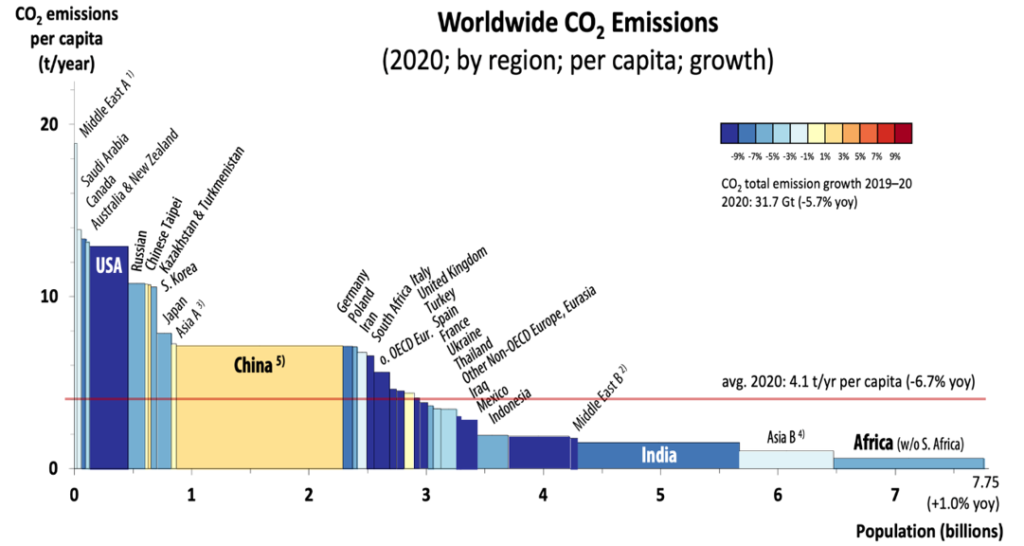

Africa's path towards a low-carbon future is clear yet limited. With a large population

and the need for sustainable economic growth in the next three decades, Africa must

address extreme poverty, which is at alarming levels globally and reduce emissions. As

shown in Figure 4, Africa contributes the least to global emissions. To meet these

challenges, Africa requires an energy source that is abundant enough to meet the

growing population's needs, reliable enough to provide continuous energy throughout

the year, and affordable to address the dire needs of Africans. The combination of

natural gas and renewables appears to be the key to meeting Africa's future energy

demand.

Again, the link between African gas usage and the current climate change drive is completely not related. This is based on IEA’s insights during the African Energy Outlook launch in 2022: “If we make a list of the top 500 things we need to do to be in line with our climate targets, what Africa does with its natural gas does not make that list”. This has been said for all Africa’s future, heavily relying on natural gas without significant climate concern while generating adequate economic revenue to fund its just energy transition. Globally, the changing narrative in favour of natural gas investments

is continuing across all regions.

The role of natural gas in powering Africa’s future

This can also be seen with the new EU parliament’s recent vote in favour of natural gas acceptability as a “green” tag. Gradual investment opportunities are sailing through, with the current 17 projects identified for investment partnerships in Africa, including Italy’s Eni’s agreement in Algeria, Egypt, and Congo, while Norway’s Golar signed MoU with

Nigeria’s NNPC for floating LNG in April 2023. Despite timely and encouraging decisions, more such investments are needed to meet the future energy needs of both on the global scale and in Africa.

Prospects for natural gas demand growth in Africa

Given the young, burgeoning, and rapidly urbanising African population and strong

projected economic growth, the energy sector has a vital role to play in Africa’s future.

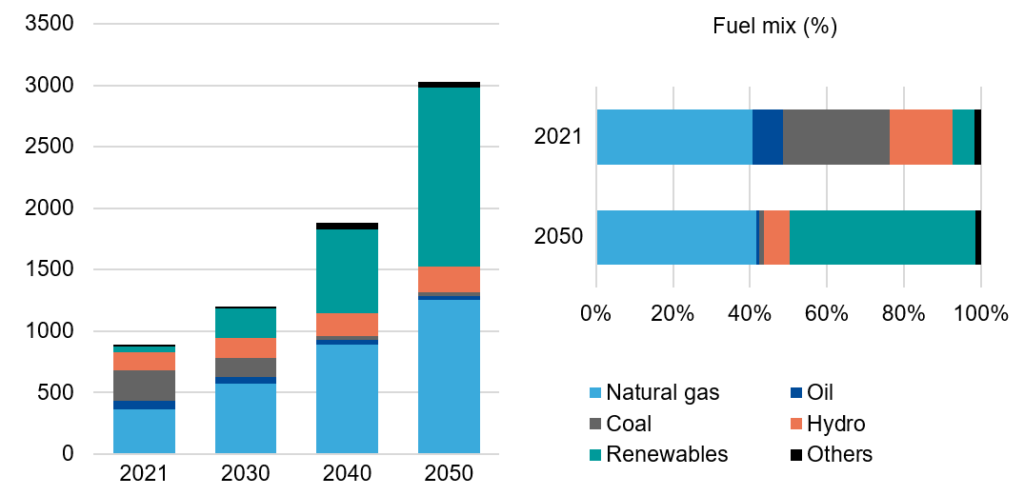

According to the GECF GGO, the continent’s primary energy demand is expected to

increase by 82% from 860 Mtoe in 2021 to 1,565.

Sub-Saharan Africa is expected to account for 84% of this growth amid higher living standards, signaling better access to energy and improvements in the energy poverty problems.

Natural gas will be responsible for around 30% of Africa’s total energy demand increase – the most significant gain of any fuel. Natural gas endowment confirmed by a series of

significant discoveries fits well with Africa’s push for industrial and social development.

Africa will enjoy an LNG export expansion while resulting revenues will help to drive

economic growth and structural transformation.

Enhancement and expansion of infrastructure could be a potential stumbling block, but a number of countries, both established gas producers and emerging ones with significant resource potential (to name a few, Mozambique, Tanzania, Senegal and Mauritania), have plans for pipeline construction and network development to stimulate domestic gas demand, despite the strong export orientation of the projects.

Simultaneously, in addition to long-distance pipeline development (e.g. the Trans- Saharan Gas Pipeline and the Mozambique to South Africa Pipeline), options such as gas-by-wire within the same regional power pool or small-scale LNG solutions will create new sources of demand allowing African nations to monetise locally produced gas and intensify intra-region integration.

With targets to ensure universal access to electricity and the need to meet the substantial power deficit, especially in sub-Saharan countries, power generation will provide the lion’s share of gas demand increase in the region. From an economic and environmental view, there is significant scope for gas to displace oil-fired generation, to constrain the expansion of coal-fired capacity in South Africa and its neighbours (where coal is a dominant source), and to enable accelerated electrification. Natural gas will also play an increasingly important role in sub-Saharan countries that continue to depend on hydropower, ensuring a backup during dry spells.

According to GECF estimations, electricity generation in Africa will surge from 890 TWh

in 2021 to 3,025 TWh in 2050 l. Natural gas is forecast to cover more than 40% of the total growth and account for 42% of the regional power generation mix by 2050. In this regard, natural gas, in tandem with renewables (which will grow rapidly

Rising gas availability will also encourage demand in gas-based industries such as

petrochemicals, methanol, and fertilisers. Many industrial projects proposed for several

sub-Saharan countries provide strong commercial cases for domestic gas market

development. Simultaneously, natural gas as a key fertiliser input will contribute to

agricultural sector productivity and play a role in ensuring food security. In addition,

there is potential for gas to penetrate the residential segment while helping to move

away from the use of traditional biomass, thereby alleviating air pollution and preventing

deforestation.

Overall, natural gas is assumed to be Africa’s greatest opportunity as a long-term energy solution to help alleviate energy poverty, enhance the quality of life and meet the

expected economic growth. Investments and capacity building are the main prominent

steps to take moving forward.

At the same time, while investments by both international and regional funders are

eminent, there has been a skill gap in Africa that will continue to enable domestic

technology and skills transfer among Africans.

Africa has relied on other continents to meet its skilled labour in the energy sphere and moving forward will require a comprehensive policy approach to meet the critical needs of Africa for the future. This isbin addition to waving a new prospect of Circular Carbon Economy (CCE) initiatives,bparticularly Carbon Capture Utilisation and Storage (CCUS) in designing the African

The role of natural gas in powering Africa’s future

pathway for a low-carbon future. In this context, adoption of natural gas, proven

technologies, such as CCUS, and renewables will ensure accelerated economic growth,

climate targets and the attainment of the UN’s SDGs.

Conclusion

Meeting the UN SDGs targets while simultaneously growing the African economy

requires an affordable and abundant energy source that can fulfil the expanding

population needs of Africa, calling for all energy sources to be adopted in a different mix. Despite its immense potential, renewable energy alone is unsustainable for this purpose. Therefore, abundant natural gas reserves and their low-carbon credentials play a crucial role in meeting the competing trends of population growth and energy poverty needs in Africa. To achieve this, the projected demand growth of 82% by 2050 must be met by a set of energy sources with natural gas in the lead to fulfil the urgent urbanisation and industrialisation in Africa.

Africa can utilise its abundant gas reserves to meet its growing energy needs and fund

its just and inclusive energy transition, which requires a combination of natural gas and

renewables with CCUS technology in hard-to-abate sectors. Achieving this implies a

purposeful capacity-building policy that facilitates in-house technological transformation, rapid skills transfer, and provides an enabling environment for higher education and research centres.

Furthermore, Africa being home to many Member Countries of the GECF, the gas

export potential via pipelines, integrated African market for gas, and regional

monetisation could benefit policy drive, maximising both the LNG and pipeline exports

while providing much-needed within-continent growth. It is undeniable that Africa needs

more affordable energy to achieve economic prosperity.